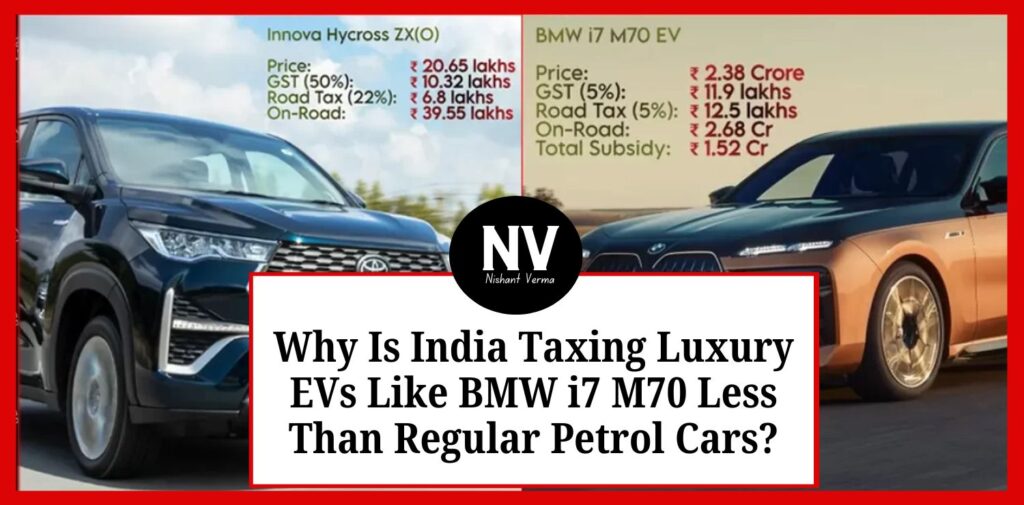

India’s tax policy on electric vehicles (EVs), including high-end models like the BMW i7 M70, priced at ₹2.38 crore, has sparked a debate. While this luxury EV is taxed at a mere 5% GST, regular petrol cars face a significantly higher tax burden, with GST and Cess ranging from 29% to 50%. This article explores why the Indian government has adopted such a strategy and examines both the benefits and criticisms.

The Luxury EVs Revolution: A Push for Sustainability

The primary reason behind the reduced GST rate on EVs is India’s commitment to promoting green and sustainable transport solutions. The government aims to reduce carbon emissions and dependency on fossil fuels, pushing consumers towards environmentally friendly vehicles. By keeping the GST at 5%, the government hopes to make EVs more attractive, even for luxury models like the BMW i7 M70, which are typically out of reach for most Indians.

Reducing taxes on EVs is part of a broader strategy to combat air pollution and mitigate climate change effects, two significant concerns for India. Additionally, the long-term goal is to reduce India’s oil imports and shift toward a greener future, which has been emphasized in recent policies encouraging EV adoption.

Petrol Cars: Higher Taxes Due to Environmental Costs

On the other hand, regular petrol and hybrid cars, which contribute to air pollution, face higher taxes. The GST and Cess on these vehicles range between 29% and 50%, depending on engine size and car type. This substantial tax burden on petrol cars reflects the government’s intent to discourage reliance on fossil fuel-powered vehicles, which contribute heavily to pollution and global warming.

Furthermore, the taxes on petrol cars contribute significantly to government revenue, funding infrastructure projects and public services. The contrast in tax rates highlights the government’s dual approach: taxing more polluting vehicles higher while incentivizing cleaner technology like EVs.

Import Duties on Luxury EVs: A Hidden Tax?

While the GST on the BMW i7 M70 is only 5%, it’s essential to consider the import duties that significantly increase the overall cost. This luxury EV is imported as a completely built unit (CBU), which attracts import duties of up to 100%, doubling its base price. For instance, the i7 M70’s pre-import price is approximately ₹1.25 crore, but after duties, it reaches ₹2.5 crore. Thus, while the GST on luxury electric vehicles is low, the actual taxation includes these substantial import duties, which are absent in domestically produced cars.

Criticism and Controversy: Favoring the Ultra-Rich?

The tax benefits for luxury EVs have raised concerns, with critics, including political figures, questioning whether these incentives are fair. Congress recently pointed out that ultra-luxury EVs like the BMW i7 M70 receive significant tax breaks, while ordinary Indians pay higher taxes on petrol cars. The party argued that each BMW i7 M70 sold could fund six public buses, calling the policy a benefit for the ultra-rich at the expense of public welfare.

This criticism highlights a broader debate: should luxury EVs that only a small percentage of wealthy individuals can afford receive such tax breaks? While the policy aims to promote cleaner vehicles, some argue that the benefits should be better distributed across the population, focusing on making EVs affordable for middle-income households rather than incentivizing high-end models.

Global Context: How Other Countries Handle EV Taxation

India is not alone in offering tax benefits for EVs. Many countries, particularly in Europe, have implemented policies to incentivize the purchase of electric vehicles through reduced taxes, subsidies, and rebates. However, the difference lies in the focus—most nations prioritize making mass-market EVs affordable for the general public, whereas India’s policy has also extended these benefits to ultra-luxury models.

Countries like Germany and Norway provide hefty subsidies and rebates for EV buyers. But in those nations, the focus is primarily on affordable EV models, with luxury vehicles often facing higher taxes. Critics argue that India should adopt a similar approach, providing more incentives for mass-market EVs rather than luxury imports.

Balancing Incentives with Equity

While the reduced GST on EVs is part of a broader plan to transition to greener transport, the current tax policy raises questions about fairness. One suggestion is that India should continue to provide tax benefits for EVs but scale these benefits based on the price of the vehicle. For instance, mass-market EVs like the Tata Nexon EV or the MG ZS EV could enjoy lower GST rates, while luxury models like the BMW i7 M70 could face higher taxes, reflecting their exclusivity and higher market price.

Conclusion: The Road Ahead

India’s tax policy on EVs, particularly luxury models like the BMW i7 M70, is aimed at accelerating the shift toward greener transportation. However, the significant disparity in taxation between luxury EVs and regular petrol cars has sparked debate. While encouraging EV adoption is critical for combating climate change, policymakers must ensure that these benefits are equitably distributed, making EVs accessible for the masses, not just the elite.

Moving forward, India may need to strike a balance between promoting green technology and ensuring that tax policies are fair and inclusive, focusing more on making EVs affordable for the common consumer while still advancing the sustainability agenda.